Purchase your high-quality fake bank statement and a real bank statement from Pro Print Works Company at affordable prices.

What is a Bank Statement

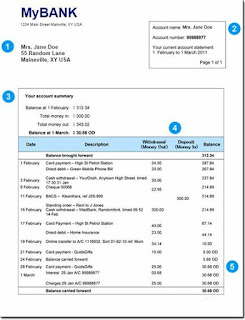

A bank Statement is a record, ordinarily sent to the account holder consistently, summarizing the complete transaction of the account through a given period from the previous statement to the current one. The opening balance from the earlier month added to the total of all exchanges amid the period results in the closing balance for the current state. Shoppers ought to deliberately audit their bank proclamations and keep them for their own monetary records. Pro Prints offers both the fake bank statement and Real Bank Statement to clients on daily basis, with or without database registration under the bank system. Fake bank statement and Real verified bank statement can be issued by Pro Print Works.

how to make a fake bank statement, create bank statement, bank statements bank of America, make real bank statement. There are four fundamental kinds of financial statements:

how to make a fake bank statement, create bank statement, bank statements bank of America, make real bank statement. There are four fundamental kinds of financial statements:

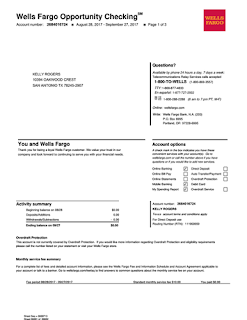

At proprintworks, we know our way around perfect when it comes to create bank statement, also you can buy a replacement bank statement from us, if you ever need to make a fake bank statement, how to make a fake bank statement you can always rely on our company. We have the full access and connections with banks in America like Bank of america, wells fargo Bank, Barclays and other top ranked banks. Feel free to contact for any bank transaction related documents you need.

create bank statement

How a Bank Statement WorksA bank issues a bank statement to an account holder that shows the detailed activity in the account. It allows the account holder to see all the transactions processed on their account. Banks usually send monthly statements to an account holder on a set date. In addition, transactions on a statement typically appear in chronological order.

|

| Fake bank statement, editable template |

Special Considerations

Many banks offer account holders the option of receiving paper statements or using paperless, electronic ones, usually delivered via email. An electronic version of a bank statement is known as an electronic statement or e-statement and allows account holders to access their statements online where they can download or print it. Some banks email statements to customers as an attachment. Some bank automatic teller machines (ATMs) offer the option to print a summarized version of a bank statement, called a transaction history.

Some institutions charge for paper statements, while many online-only banks require digital delivery.

Even with the convenience, value, and accessibility of electronic statements, paper statements aren't likely to go away anytime soon. As of 2015, about a third of U.S. residents don’t have internet access, according to Pew Research Center.

A survey in 2017 by Two Sides North America found that nearly 70% of consumers find it easier to track expenses and manage finances with paper statements. Two-thirds prefer a combination of paper and electronic statements. Many recipients of e-statements still print out their statement at home, preferring to keep a permanent record.

Benefits of a Bank Statement

During the reconciliation of their bank account with the bank statement, account holders should check for discrepancies. Account-holders must report discrepancies in writing as soon as possible. A bank statement is also referred to as an account statement. It shows if the bank is accountable with an account holder’s money.

Bank statements are a great tool to help account holders keep track of their money. They can help account holders track their finances, identify errors, and recognize spending habits. An account holder should verify their bank account on a regular basis—either daily, weekly or monthly—to ensure their records match the bank’s records. This helps reduce overdraft fees, errors, and fraud.

If any discrepancies are found, they must be reported to the bank in a timely manner. Account-holders usually have 60 days from their statement date to dispute any errors. They should keep monthly statements for at least one year.

Requirements for a Bank Statement

Parts of a bank statement includes information about the bank—such as bank name and address—as well as your information. The bank statement will also contain account information and the statement date, as well as the beginning and ending balance of the account. Details of each transaction—notably the amount, date, and payee—that took place in the bank account during the period will also be included, such as deposits, withdrawals, checks paid and any service charges.

For example, a bank statement may show a non-interest-bearing checking account with a beginning balance of $1,050, total deposits of $3,000, total withdrawals of $1,950, an ending balance of $2,100, and zero service charges for the period Sept. 1 through Sept. 30.

REASONS FOR BALANCING ACCOUNT EVERY MONTH

Catch mistakes made in transactions

One of the biggest reasons you should balance your checking account to your statement is to catch any mistakes with your record keeping. It may seem obvious if you are keeping track manually, but even if you are using software, you may make mistakes in entering your deposits or transactions (or the software may make mistakes in auto-importing them). These may be minor differences, but transposing two numbers will throw your balance off. Balancing to your bank statement will help catch those and prevent you from accidentally overdrawing.

Track your spending When you balance your checking account, you can also track your expenses.

It is very easy to do this with personal finance software that provides a running total. When you enter the transaction into your app, it will automatically track your spending so that you know when to stop. The software helps you plan for the annual expenses because you can look back over your spending for the year and see things you may have forgotten to include in your budget.

Notice Mistakes Your Bank Has Made

Banks have been known to make mistakes. However, if you are not balancing to your account, you may not realize that a deposit is missing or a withdrawal is unauthorized. There is a paper trail that the banks use, and you should be able to work with your bank to correct any errors—but only if you catch them.

Identify theft is becoming more and more common. Your debit card information may have been stolen. The thieves then use the card information to make purchases online. Sometimes these are large transactions, but sometimes they do several smaller transactions to try to sneak by unnoticed.

Catch Fraudulent Changes

Banks and credit card companies have a period of time in which you can report fraudulent charges, usually between 30 and 90 days from the date of the statement. If you don't balance your statement, you may not catch these until it's too late. You might also notice things like a transaction that was accidentally run twice at a store.

Be Aware of Where You Are Financially

If money is tight and you are living from paycheck to paycheck, then you need to carefully track your spending to make sure you do not accidentally overdraw your account. This can easily happen if you are married and you are both accessing your checking account. It is important to balance your account so that you know where you are and how much money you have left to spend until

Discover Missed Automatic Payments

You may have an automatic payment set up to pay club dues, medical bills, insurance, or other small monthly payments. These payments should go through without a hitch, but sometimes if the company has switched over to a new system or you get a new credit card number, the payments may not be processed. In some cases, it may not be a big deal, but if it ends up with your insurance being canceled or you get hit with late fees, it could cost you more than you expect. When you balance your statement each month, it allows you to catch these mistakes and contact the company before there are any

Stop Small Things From Becoming Big Things

When you balance your account, you may catch small fees or mistakes that do not seem like a lot on the surface. You may remember to record the ATM withdrawal, but not the additional fee that your bank charges for using a different bank’s ATM. These fees may be small, but if you do not account for them in your balance, you may end up overdrawing your account and incurring even more fees.

REASONS TO MAKE A FAKE BANK STATEMENT

Hide your earnings

A Fake bank statement is a great way to hide your earnings and keep your money safer and Better, In the United States especially, most of us are uncomfortable with the idea of broadcasting our salary. We’re not supposed to tell our neighbors. And we’re definitely not supposed to tell our office neighbors. To many people, it’s the polite and right thing to do to keep your pay to yourself—to keep your salary secret. The assumed reason is that if everybody knew what everybody got paid, then all hell would break loose. There would be complaints. There would be arguments. There might even be a few people who quit. But what if secrecy is actually the reason for the strife, and what would happen if we removed that secrecy?

It is revealed in that pay transparency—sharing salaries openly across the company—makes a better workplace both for employees and for the organization. When people don’t know how their pay relates to their peers, they either think that they’re being underpaid and maybe discriminated against or worse they actually are.

Pay secrecy leads to what economists call information asymmetry a situation where one party in a negotiation has loads more information than the other. And during initial hiring or annual raise or promotion discussions, that information asymmetry gives an employer the advantage—and they can use that advantage to save a lot of money. Imagine how much better you could negotiate for a raise with all that information.

I think we’re almost there, getting a fake bank statement to keep every employee in tact and dealing safer with the organisations earnings through the help of the specialists at proprintworks.

Most people have no idea whether or not they’re paid fairly. In a 2015 survey of over 70,000 employees, an astonishing two-thirds of people who were paid at the market rate believed they were actually underpaid. And the majority of those who felt they were underpaid intended to quit, even if they were paid at market rate

Take a loan

Bank statement loans, also known as self-employed mortgages, allow you to secure a mortgage without the documentation you would normally use to verify your income, such as W-2s and tax returns. These loans, sometimes known as "alternative documentation loans," are largely used by entrepreneurs and others who might not have consistent income or a single employer to prove their salary.

With the rise of the gig economy, there are now somewhere between 15 and 27 million Americans who get some or all of their income from self-employment. 1

?Fortunately, a number of lenders offer bank statement loans, which provide more flexible alternatives to proving your income and assets.

How Bank Statement Loans Work

Instead of requiring tax returns pay stubs, and employer verification forms, bank statement loan applicants can use their personal and/or business bank accounts to prove their income and cash flow.

You’ll still have to provide some of the same documentation as you would for a regular loan, of course--and often more. Below are the typical requirements for a bank statement loan.2?

Twelve to 24 months of personal or business bank statements

Two years’ history as a self-employed professional?

Decent credit score (the exact score minimum varies, depending on the lender)

Enough cash or liquid reserves to cover several months of your mortgage payment

Verification of any liquid assets, like a 401k or mutual fund investment

A business license, if applicable

A letter from your tax preparer or accountant validating your business expenses and confirming that you file your returns as an independent contractor4?

The exact requirements vary from lender to lender. For example, some mortgage lenders may accept lower credit scores than others, and some may allow gift funds while others will not.

If you don’t meet the requirements for one lender, be sure to shop around and see if you meet the criteria for another.

Since these loans are slightly riskier for lenders, they may require larger down payments than conventional loans, and have higher interest rates.5?

Who May Benefit From a Bank Statement Loan?

Bank statement loans are often used by borrowers who have inconsistent cash flow or can’t get income documentation from an employer, such as consultants, freelancers, small business owners, doctors, lawyers, and real estate investors and agents.6?

If you fall into this category, you may not be able to qualify for a conventional or FHA mortgage loan because the income on your tax returns—which is often adjusted for deductions and business write-offs—might not reflect the true amount of income you’re earning. Your bank statements, however, tell a different story, allowing you to qualify more easily.

Existing homeowners can also use bank statement loans when refinancing their mortgages. If you’ve quit the traditional workforce since purchasing your home, but would still like to enjoy the benefits of refinancing, these loans may be a good option.

Other Alternatives

Keep in mind that some self-employed people can qualify for a traditional loan. Most lenders verify income by looking at the average of the last two years of your tax returns. So if you’ve been self-employed for a significant amount of time (at least two years) and your income has remained steady or grown during that time, you may still be a candidate for a conventional mortgage.7?

A larger down payment and good credit can also help your chances of getting a mortgage as a self-employed person, as can having a co-borrower with a high credit score. These factors may also qualify you for a lower interest rate.

Finally, consider using a mortgage broker to help with your loan shopping. These professionals have access to a wide variety of lenders, so they may be able to point you to a specialized loan program that fits your needs.8?

|

| Bank statement Template |

https://proprintworks.com/real-and-fake-bank-statement-pay-slips-and-utility-bills/

ReplyDelete